If you are a salaried individual, don’t forget to select your preferred tax regime before the end of this month. Or else, the default – which is the new tax regime – shall set in. Which means that your employer will deduct TDS accordingly and the exemptions and allowances will not be applicable.

The old tax regime has numerous deductions (Section 80C) and exemptions (eg: HRA and LTA). These are missing in the new regime.

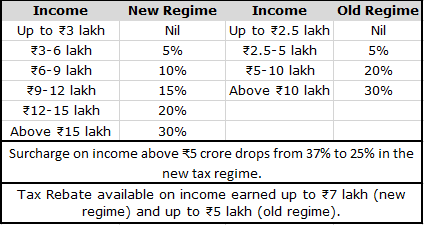

However, under the old tax regime, a maximum ₹12,500 rebate is given if the taxable income does not exceed ₹5 lakh. The new tax regime provides a Rs 25,000 rebate if taxable income does not exceed ₹7 lakh.

Those earning above ₹7 lakh will have to decide which works best for them.