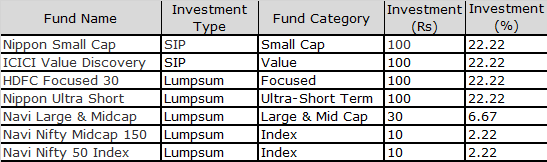

I am 21-years old with moderately high-risk appetite. I just started investing. My investments: Nippon Small Cap (SIP-100), ICICI Value Discovery (SIP-100), HDFC Focused 30 (Lumpsum-100), Nippon Ultra Short (Lumpsum-100), Navi Large & Midcap (Lumpsum-30), Navi Nifty Midcap 150 (Lumpsum-10), Navi Nifty 50 Index (Lumpsum-10). Please suggest any changes.

To start with, we’re assuming that the numbers that you have mentioned in the closed captions are the amount that you’re investing in multiple terms. Based on this, we’ve calculated the percentage of your investment across each fund.

Allocations:

- Mid Cap: 25.56%

- Small Cap: 22.22%

- Value: 22.22%

- Focused: 22.22%

- Debt: 22.22%

- Passive: 4.44%

- Large Cap: 3.35%

As a general rule of thumb, we recommend an 80:20 split between equity and debt for someone with a higher risk appetite and the capability to invest over the long term. From your portfolio, it’s clear that you seem to meet that criterion, having invested around 22% of your portfolio in Ultra Short-Term Funds. You might also want to consider short term and corporate bond funds that you can invest in, over a slightly longer duration.

We also recommend that an investor should ideally hold a majority of his portfolio in large cap funds so as to mitigate risks. To your rescue, we see that the value and the focused 30 fund that you hold as part of your portfolio are both large cap in nature. However, its important to remember that these funds come with a different style of investing.

For example, the ICICI Value Discovery plies a fluid investment style. Although the strategy predominantly holds large cap stocks, the portfolio manager could change this allocation in favor of mid- and small caps based on valuation. The HDFC Focused 30 on the other hand is a concentrated strategy that can tend to take high conviction bets based on their views. The fund could move across market capitalization based on the availability of ideas.

You also hold 2.22% of your portfolio in an index fund. However, this is relatively small in terms of your overall portfolio. You could look at investing some portion of your portfolio in pure play active large cap funds. Do remember that the return profiles of active and passive fund can be significantly different, so do assess these before investing as the two may not always be replaceable. Overall, your portfolio seems well placed, a few tweaks should help formulate the portfolio in a better manner.

Ask Morningstar archives

Fund research reports

Articles authored by senior research analyst Kavitha Krishnan

Registered readers can post their queries by accessing the Ask Morningstar tab. Our team will answer SELECT queries relating to mutual funds, portfolio planning and personal finance. While we provide broad guidelines, we suggest you consult a financial adviser before making investment decisions.