Is the time right to invest in Tata Digital India Fund or ICICI Prudential Technology Fund?

Before I answer your query, I would like to reproduce what my colleague Himanshu Srivastava wrote when a reader commented on the recent poor performance of ICICI Prudential Technology Fund.

"Unlike diversified equity funds, the fund manager of a sector/thematic fund does not have the liberty to shift to any other sector, when the underlying sector goes through a rough patch. As is the case with the IT sector. Technology funds did well during and post the pandemic , and that is when lot of investors started to invest in these funds. However, the IT sector has struggled this year, largely driven by global headwinds. Surge in interest rates globally to tackle stubborn inflation has fanned concerns that the U.S. and European economy may face a possible recession, which could impact the sales, revenue, and growth of IT stocks. This has also impacted Indian IT stocks, as a huge pie of their earnings comes from these developed markets."

Do read the following articles before you purchase a thematic fund:

How to manage risks in thematic funds

Kenneth Lamont, manager research analyst

Action points for thematic funds in a portfolio

Himanshu Srivastava, associate director of manager research

Read this before you invest in a thematic fund

Larissa Fernand, investment specialist and senior editor

The problem with sector funds

Larissa Fernand, investment specialist and senior editor

Investing in sector funds is fraught with timing risk, both on entry and exit. The nature of the market is to be cyclical, where different sectors come to the fore at different points of time.

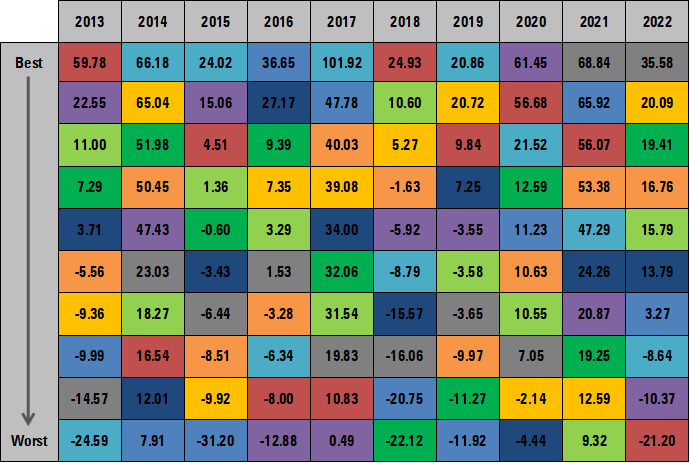

The below chart of percentage returns provides a good illustration of how sector rotation has taken place over the last 10 years (YTD 2022 is as of November 17, 2022). As is evident, sector winners continue to rotate and thus it is crucial to identify a sector early before the run up happens as well as exiting the sector before it starts to relatively underperform. This is by no means is an easy task and even professional money managers can’t predict which sector will lead the way in the near future.

It is also important that you do not buy into a sectoral fund that has done well recently. The past returns may look attractive, but that’s probably the worst time to get into a sector when perhaps its best times are behind it already. Rather if you do want to invest in a sector fund, choose a sector that’s relatively underperformed in the recent years, but you will need to be patient if the sector continues to underperform in the near term.

Our recent study on the gap between investor returns and fund returns shows us that sector funds tend to display the highest gaps as investor made poorly timed entry and exit in these funds. For e.g., as on June 30, 2022, Technology funds returns 27.49% p.a., but the investor returns (average rupee invested) in tech funds only earned 3.18%, thus creating a huge investor return gap of 24.31%!!! Tech stocks had a great run up in 2020 and 2021, but bulk of the flows came into the funds after this run up.

Most investors are better served by investing into diversified equity funds, whereby active managers will express their view by taking modulated overweight or underweight calls on sectors rather than it being a binary allocation.

If you do want to take sector fund exposure, keep the allocation to not more than 10% of the portfolio across sector funds and not more than 5% in a particular sector.

ASK MORNINGSTAR archives

Registered readers can post their queries by accessing the Ask Morningstar tab. Our team will answer SELECT queries relating to mutual funds, portfolio planning and personal finance. While we provide broad guidelines, we suggest you consult a financial adviser before making investment decisions.