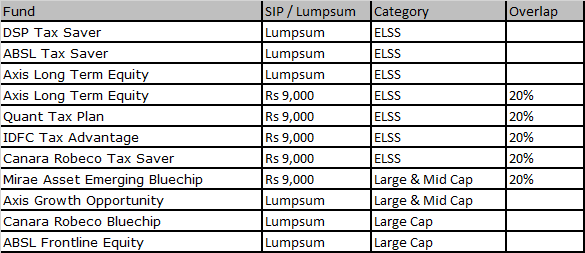

I want to accumulate Rs 2 crore over 15 years. My SIPs of Rs 9,000 each in Mirae Asset Bluechip Emerging Fund, Quant Tax Plan, IDFC Tax Advantage, Canara Robeco Tax Saver, Axis Long Term Equity. I have lumpsum investments in Canara Robeco Bluechip DSP Tax Saver, ABSL Frontline Equity, ABSL Tax Saver, Axis Long Term Equity, Axis Growth Opportunity.

All the 10 funds that you have listed are from three categories: Large & Mid Cap, Large Cap and ELSS, which are equity linked saving schemes. Amongst these, you have a dominant exposure towards the ELSS category.

Considering that there is a limit to the tax advantage that ELSS funds can provide, you might want to consider other funds that could provide more value to your portfolio based on your goals.

From a diversification perspective, it would be wise to include some small- and mid-cap funds in your portfolio. In addition to this, you could also look at allocating your investments across other asset classes like debt, gold ETF’s and international equities depending on your risk profile.

Another important factor to keep in mind is that funds that fall in the ELSS category mostly focus on investing in large-cap stocks. Hence, there is a significant similarity when it comes to the holdings of your underlying investments.

Click on the images to enlarge / Source: Morningstar Direct

When I analysed the portfolio, I saw a significant overlap between Axis Long Term Equity and Axis Growth Opportunities, and an overlap between Mirae Asset Emerging Bluechip Fund, Canara Robecco Taxsaver, Canara Robecco Bluechip Equity Fund, IDFC Tax Advantage, DSP Tax Saver, Aditya BSL Frontline Equity and Aditya BSL Tax Saver.

In the below chart, for example, Canara Robeco Bluechip Equity and Canara Robeco Equity Taxsaver have an overlap of 0.72. This means that 72% of the portfolio is common between the two funds. ABSL Frontline Equity and Canara Robeco Bluechip Equity have an overlap of 0.65. This means that 65% of the portfolio is common between the two funds.

RELATED READING

In order to evaluate if your investments will yield that kind of growth that you are looking for, I would urge you to use this SIP calculator

Ask Morningstar archives

Fund research reports

Articles authored by senior research analyst Kavitha Krishnan

Registered readers can post their queries by accessing the Ask Morningstar tab. Our team will answer SELECT queries relating to mutual funds, portfolio planning and personal finance. While we provide broad guidelines, we suggest you consult a financial adviser before making investment decisions.