I started investing in stocks in March 2020 with Rs 45,000. I have no other investments, other than LIC policies. I would like to invest Rs 10,000-Rs 15,000 every month. I am 37 years old and my goal is retirement.

You haven’t mentioned a specific investment time horizon. However, since you did state retirement as the goal, that gives you at least 20 years. While we advocate saving for retirement as early as the 20s, there is no need to fret. You still have two decades.

The reason we say one must start early is because the shorter the time frame to your goal, the more you need to save. For example, if you want to accumulate Rs 4 crore in 15 years, start with a monthly SIP of Rs 58,000, and increase it annually by 10%. If you want to accumulate Rs 4 crore in 20 years, start with a monthly SIP of Rs 27,000, and increase it annually by 10%. (This is based on the assumption of returns of 10.5% for equity and 6% for debt).

Also, one needs a long time frame when considering equity. We would recommend keeping at least a minimum time horizon of 7+ years, ideally 10+ years. Equities is a volatile asset class and has witnessed significant and prolonged period of flat or negative returns, thus it is important to have a time horizon that helps you ride over the volatility.

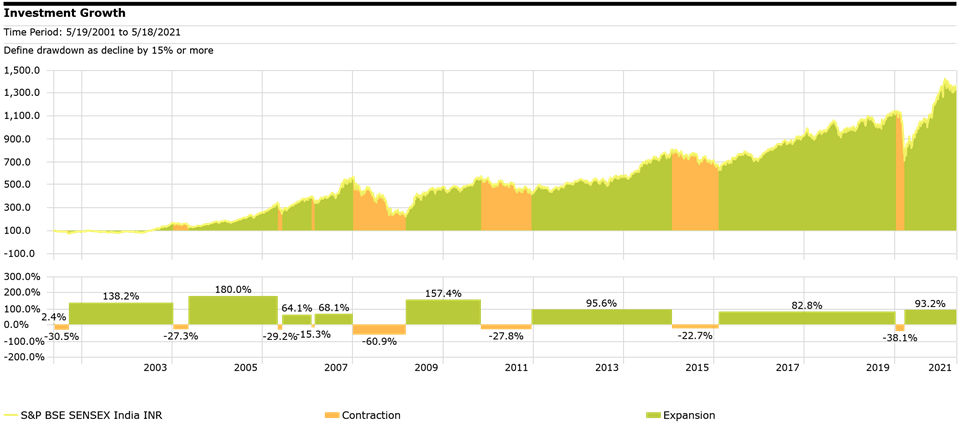

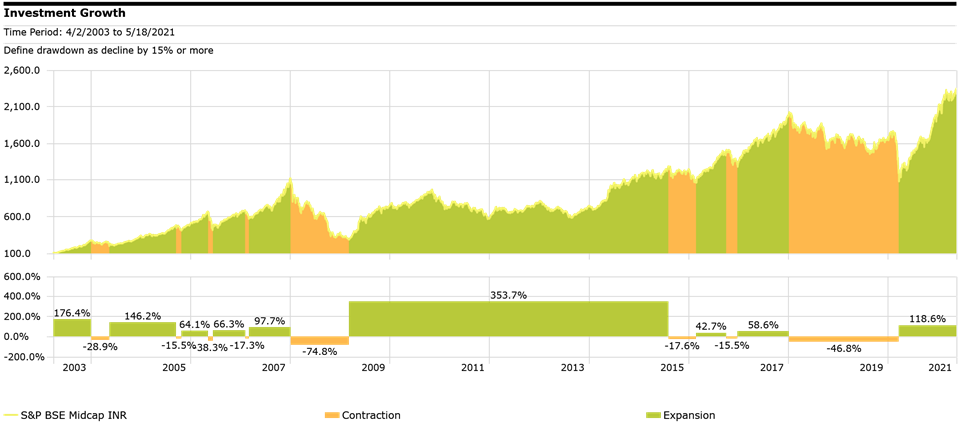

The charts below show the movements in the broader market index and the mid-cap index over the last 20 years. There have been significant down moves in the market multiple times that took a fairly long period of time to recover. When it comes to the mid-cap index, the drawdowns can be more dramatic and last longer.

click on the image to enlarge

- Invest systematically. It is extremely important to have a long-term investment mindset as well as invest regularly.

- Increase SIP amounts by a minimum of 10-15% each year.

- Follow a glide path approach towards investing, by reducing equity exposure gradually as you start approaching your intended goal date.

We recommend the following:

- Fixed Income: Short Duration/Corporate Bond Funds: 10%

- Equity: Large Cap & Flexi Cap Funds: 60%

- Equity: Mid & Small Cap Funds: 20%

- International Equity Funds: 10%

You can pick funds from the list here. Also read why you need global funds and how to invest abroad.

Registered readers can post their queries by accessing the Ask Morningstar tab. Our team will answer SELECT queries ONLY relating to mutual funds and portfolio planning.